Here is an interesting question: two small business owners have just sold their businesses and want to invest the proceeds. One sold for $1,000,000 and the other sold for $500,000. They both make the same investment and achieve the same return. Which one will retire with more money?

The answer is: you can’t tell on these facts. The most important fact is how old each person is. If the investors are the same age, then the one who started with more will finish with more. But if the one with less to invest is younger, things get really interesting.

Let’s say that the two investors are aged 30 ($500,000) and 50 ($1,000,000). And they both make an investment into an index-based exchange-traded fund. If you do not know what that is, don’t worry. For now, just understand that the return on the investment will be the same as the market average. Over the twenty years to the end of 2015, the average return in the share market was about 8.7%. Average inflation was around 3% per year, meaning that the average return after inflation was around 5.5%.

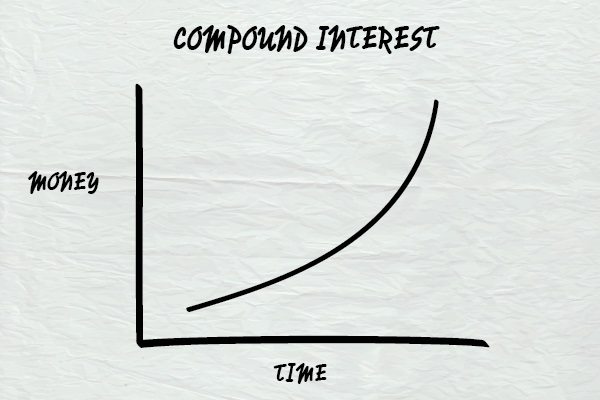

An investment returning around 5.5% will double in value every thirteen years. So, after 13 years, the $500,000 has become $1,000,000 and the $1,000,000 has become $2,000,000. And the investors are now aged 43 and 63. The second one is about to retire – with $2,000,000. But the first investor has another 20 years to go. If his investment continues to grow at 5.5%, then by the time he reaches 63 he will have $2,900,000 available.

The business owner who sold his business for half the price ends up with 45% more to retire with. And these are inflation-adjusted figures, so the difference between the two retirement amounts is not affected by inflation. The owner of the smaller business really does end up with more.

The difference is all about timing. The sooner you start investing, the better. This is such an important point that it is worth restating in a different way: the time you start to invest can be more important than how much you decide to invest – and maybe even what you actually invest in.

This is a really important point for business owners. How many times have you heard a business owner say ‘my business is my superannuation?’ The problem is that these business owners are waiting to sell their business before they start investing for their retirement. They are leaving it too late.

The problem is a real one. The Association of Super Funds of Australia report that almost 30% of self-employed people have no super at all. If these people are thinking about retirement at all, then they are leaving it way too late to start this form of investing. As the example above shows, late starts simply can’t be made up.

Cash flow is usually the main reason that businesses leave super until it’s too late. And we get it. Cash flow can be hard and there are always a hundred demands on what cash you do bring in. But it is still imperative that you try to get even a little bit away into super each year.

Let’s say you pay marginal tax at 30%. If you give up just $70 a week after tax, then you will be able to contribute $100 per week into super. This gets taxed at just 15% – meaning that your foregone $70 has instantly turned into $85. If you then invest that $85 into an investment that gets the market average of 5.5% after inflation, then in ten years’ time you will have just under $57,000. Do it for 20 years and you will have $155,000. Do it for 30 years and you will have more than $320,000.

$10 a day snowballing into $320,000 – in today’s dollars – in 30 years time.

You can see why you really need to start investing today, at the very latest. Give us a call and we can show you how to get started with investing.