Introduction

Often, businesses are the best investments. We regularly recommend clients buy or start businesses, or further develop existing businesses, wherever a client is suited to this by inclination, personality or training. The extra economic benefits, improved tax planning and, hopefully, the CGT free profit on the ultimate sale of the business mean this is an option clients cannot afford to overlook.

In this ebook, we look at three particular aspects of a successful business. These are:

- The business plan

- Staffing

- Time management

The list of things that could be included in an ebook about business is almost endless. However, our experience is that these three elements are the ones that need most attention. Happily, they are also the ones where improvements – even little ones – make large differences. So, like all good plans, let’s start at the beginning…

Chapter 1: Creating a business plan

A successful business does not happen without effort. It is the result of a good idea, implemented in a systematic way, over a period of time, according to the pre-conceived plan or schedule. This is the case whether the business is being started from scratch, or whether it is an older business entering a new phase of activity and growth. This is also the case regardless of business location and competition.

A good business plan reflects the owners’ personal preferences and ambitions. It accommodates private lives (of the owner) and, by anticipating expected problems, helps to reduce future stress levels. If there is a plan for what is going to be done and why, the chances are it will be implemented more successfully and with much less angst. For example, a good business plan will cater for peak workloads through strategies such as introducing new support staff well before the peak workload arises.

Sometimes the plan is in the owners’ heads. They have strong views on what will work and they set about doing it in a determined way. That is commendable and there are many examples where this has worked well and has produced good results. However, the prospects of good results are greatly increased, and the prospects of bad results are greatly decreased, if the plan is documented. This should be done in a disciplined and structured way, identifying what should be done and what should not be done, who will do it, and why.

This is the case even if the written business plan is only to be seen by the business owner. There is something about seeing the plan on paper that makes it more concrete – and which also allows gaps or inadequacies in the plan to be identified and fixed.

It is a good idea to analyse and check the plan regularly. How regularly  depends on circumstances. For established businesses experiencing little growth once a year may be appropriate. For businesses that are experiencing great change the business plan may be reviewed more frequently. In each case monitoring and up-dating the business plan is an intrinsic part of developing and maintaining a successful business.

depends on circumstances. For established businesses experiencing little growth once a year may be appropriate. For businesses that are experiencing great change the business plan may be reviewed more frequently. In each case monitoring and up-dating the business plan is an intrinsic part of developing and maintaining a successful business.

Owners can choose to develop their own business plan or they can seek the help of a consultant. The following table lists out the advantages and disadvantages for both of these options:

| Creating your own plan | Seeking assistance | |

| Advantages |

|

|

| Disadvantages |

|

|

Of course, a combination of both options could be viable.

Getting started

Successfully executed, a business plan should maximise business profit. This will, in turn, maximise the goodwill in the business.

Start with a vision. Planning cannot occur without one. Formalising the process can help turn abstract concepts and ideas into a practical reality. Formal statements about the visions and plans of the business are often developed; this enables owners to more easily communicate their plan, which in turn allows them to better manage performance and outcomes. This formal statement is called a “vision statement” and is usually kept short and simple to best-express the core ideas about the future direction the business intends taking.

To assist with creating a vision statement, owners should first establish a set of principles and values that will underpin their business.

Once the principals, beliefs and values of the business have been developed the meaning of each value needs to be reflected upon. Questions should be asked such as:

- what each value is about and what it really means

- whether it is fully understood by staff and clients

- what other ideas are associated with each value

The values can then be translated into a set of principles and standards of behaviour within the business and incorporated into the vision statement.

Thinking about the clients

An ethos of client care and support should dominate the plan. If this occurs the business should flourish under all measures of success, especially client service and business profitability.

The owner will need to define the demographics of the business. The planning process should then be developed around meeting the needs of the type of clients it will be serving. Identifying the potential client base is an important factor when thinking about the type of services that will be provided.

Thinking about the owner

A good business plan reflects the personal preferences and ambitions of the owners. Apart from setting goals and selecting strategies, the good plan also accommodates private lives.

The process of preparing a business plan allows the owners to identify what is important to them and allows their preferred lifestyle to be considered. For example, the needs of a young family may dictate the hours the business is open: Saturday morning sport makes this time unavailable to the business.

The business plan process often presents a good opportunity for reflection on the priorities of the business owners – and for thereby ensuring congruence between personal and professional goals.

In our observation, this is one of the least-well recognized elements of a business plan. Too many business owners let their private lives (especially family) run second to the business. Usually, the thinking is that the business is needed for the family to flourish. And this is often true. But it is also true that factoring the family into the business plan will keep personal responsibilities in focus, which will allow them to be prioritized whenever possible.

Put simply: too many mums and dads miss too many netball or football games.

What a business plan looks like

There is not one standard format. A business plan is not a precise formula to be strictly adhered to no matter what the circumstances of the owners are. It is a document with some opportunity for flexibility, reflecting the needs of the people who created it and use it.

Nevertheless, some broad guidelines can be set out to assist in preparing business plans. Within common sense limits, a business plan can be as short or as long as one wishes it to be. It can be filled with detail, or devoted solely to the big picture. The plan should reflect the unique needs of the business. As it is their document the plan should be written by the owners, using outside assistance if required. Using a template or a precedent can assist in developing a logical and consistent strategy for conducting the business in both the short and long terms. This is particularly the case if a third party, such as a potential partner or a bank, is going to view the document.

One suggestion for a business plan is set out in the table below.

| Category | Contents |

| 1. Background Information |

|

| 2. Mission |

|

| 3. Business Position |

|

| 4. Organisational Strength |

|

| 5. Strategic Audit |

|

| 6. Grand Strategy |

|

| 7. Functional Strategies |

|

| 8. Implementation |

|

Executive Summary

This is an overview of the business plan. Although it comes at the start of the document, it is usually prepared after the body of the plan has been drafted. It sets out the reasons for undertaking the process and highlights the main points by placing them into context.

The summary sets out the basic information required for the business plans’ audience. This section should also contain an overview of the key activities of the business and the variety of services offered. It should include an overview of the target markets of the business, who the competitors are and what competitive advantages it has over them. Then it should determine the projected profits from these services, what the capital needs are, who will be contributing these, and what security will be offered.

Mission

The mission statement should provide a succinct outline of the business’ purpose. It defines the business’ goals, objectives and values. A well-written mission statement should clearly communicate the fundamental business objectives and goals and how it will achieve these in accordance with the business’ core values.

Business position

This section determines where the business stands in relation to its competitors. It uses an integrated approach to assess the competitive advantages and disadvantages that the business may face. It closely examines  the client profiles through the use of demographic and other relevant information and enables the business to make informed decisions about future actions. It also looks at the competitors’ profiles.

the client profiles through the use of demographic and other relevant information and enables the business to make informed decisions about future actions. It also looks at the competitors’ profiles.

Market research of both the competitor‘s and the business’ current clients may be used. Where it is, this information must be relevant, accurate, and objective. It should enable decisions to be made relating to the following areas:

- how to promote the business

- what pricing structure to use, and what fees the competitors are charging etc

- what extra services to offer

- whether the clients live locally or cover a wide geographical area

- changes that might enable these services to be established

As a general proposition, we urge caution regarding the use of external market researchers. They can be expensive. They also cannot substitute for the business owner who knows his or her clientele and knows how best to meet the needs of that clientele.

Organisational strength

Having examined the business position, it is now time for the business plan to examine what is happening in the rest of the world. The idea is to determine where the business may have strengths. These strengths may or may not be factors that are controlled by the business. They can include, for example, technological advances, the economic climate, the availability of specific skills, client preferences, etc.

Many external factors cannot be controlled. Such factors may include:

- legislation and political/legal requirements – compliance requirements, property titles and leases, employment law, zoning and parking restrictions etc

- economic factors – interest rates and their effect on spending, economic policies, etc

- demographic factors – trends in client behaviour, aging population, etc; and

- business to business (microeconomic) factors – reliability of IT infrastructure, leasing arrangements, etc

Most internal factors, however, can be controlled. These could include:

- physical resources – the number of staff to be employed, expected client numbers, workflow, client service policies, staff appraisals, etc

- financial resources – the amount of working capital required, whether there will be adequate cash flow, access to finance, etc; and

- business capabilities – available space for increasing the number of owners, experience and expertise of practical and non-practical staff, ongoing educational needs, recruitment and selection policies, staff morale and communication

Strategic audit

having completed the above analyses, it is time to determine whether the business will be able to operate within this environment, and if so what makes the business special or different from its competitors. This is when a SWOT analysis should be undertaken. This gives the owners the chance to review the Strengths, Weaknesses, Opportunities and Threats that will affect the business.

Questions that could be asked include:

- whether the business will have the capacity to operate successfully in this market, considering the competitor analysis and client profile

- whether enough cash is available to set up business without compromising client services

- whether employees can be successfully attracted to work in the business

- have all regulations been observed

By identifying weaknesses and threats, strengths can be built upon and opportunities will present themselves allowing the business to change direction if needed. The SWOT analysis allows the business to identify what critical success factors are required to enable it to have a competitive advantage. The three main critical success factors are:

- resources – appropriate premises to operate from, adequate funds to operate successfully, and skilled staff to undertake the work, etc

- processes and systems – feedback systems, procedures and policies, operating systems, accounting systems, appropriate client relationship protocols, client confidentiality processes, etc

- services being offered, including prices and promotion of these services

Functional strategies

It is now time to develop the strategies to meet the aims of the business. Each strategy should follow the SMART principle:

| Specific | The strategy states precisely what will be achieved |

| Measurable | The strategy can be monitored or measured; |

| Achievable | The strategy is actually achievable; |

| Realistic | The successful implementation of the strategy must be achievable; |

| Time | The strategy should identify a definite time in which it will be achieved. |

The person/s responsible for implementing the strategy also needs to be identified.

Common strategies identified and articulated at this stage include:

- an operating strategy – how the business is going to run, keeping in mind the resources and processes identified earlier

- a financial strategy – budgets are drawn up for expected income and expenditures, spread sheets for costs, how much clients will be charged, whether they will be charged on on-going basis, whether it is appropriate to consider a second or even third owner, fixed costs compared to variable costs, breakeven point etc

- a marketing strategy – signage, advertising in local papers, word of mouth, website, community involvement; and

- a resources strategy – how many owners will work, how many support staff will be required, what alternative services will be offered, what awards staff will work under and similar matters

Implementation

Having identified all the activities and tasks required to achieve the goals set, it is time to put it all into operation.

A simpler alternative

The template above can be used to create a very detailed business plan for a business. Many businesses prefer something less formal and rigid – a more basic, simpler alternative..

In developing a simpler plan, ensure that Einstein’s maxim is followed:

things should be as simple as possible, but no simpler.

A basic business plan should (at a minimum) address the following basic themes:

- confirm where the business is currently

- consider where the business could be

- examine how to get there; and

- discover when you have arrived

Where the business is now

For existing business, it is important to confirm the current situation. This will entail confirming what the business’s past record, strategy and focus was.

It can then reflect on whether it has done as well as it should have, having regard to the purpose or vision of the business. If it has not, then establishing why outcomes have not been achieved will help in future planning? Important areas for any business to consider include:

- management, direction and control

- marketing

- operations

- finance

- human resources

- quality of management; and

- other strengths and weaknesses

Where the business could be

Think about the big picture. It is OK to be a little idealistic here, as everything begins with an idea. That said, be realistic. We once heard a man in a suburban cafe tell his co-diner that his ‘biggest competitor is Bill Gates.’

Time to switch competitions – you are never going to win that one.

How to Get There

Given the current situation of the business, the plan will need to include ways of achieving its identified goals, and how to become the business of its vision. This is the sharp end of the business plan. It is here the real detail sets in and actual tactical plans and proposed actions are formulated. This section sets out the key issues of who, when, what and how.

Are we there yet?

Make sure you can identify the success of the business, having regard to the objectives set for it. These signposts should include financial and non-financial criteria.

More Information

The Australian Government has quite a useful business planning tool on its business website. It can be downloaded here.

Chapter 2: Employing staff

All businesses employ staff; therefore appropriate management of these human resources is a vital process. Businesses have legal obligations to fulfil, whilst also needing to build a positive and cooperative culture. The business needs to ensure that human resources policies and procedures are kept current with changes to legislation. Business managers and owners frequently require assistance in understanding legal requirements pertaining to employment and dismissal of staff.

In Australia there are a vast number of laws that affect employers and staff. This chapter will focus directly on the recruitment process.

Recruitment process

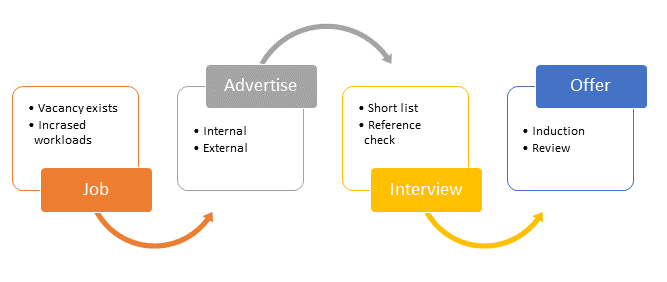

The business’s relationship with its employees is shaped through the procedures it uses and its compliance with legislation set down by federal and state governments. There are a number of steps employers need to undertake in order to recruit and select appropriate staff to fill positions in the business. Firstly, the employer will identify the need for additional human resources, either resulting from a staff member leaving or through increased workloads. A process to establish guidelines for recruitment needs to be followed.

These processes can be illustrated by a simple flow chart:

The recruitment procedure must include, but not be limited to the following criteria:

The recruitment procedure must include, but not be limited to the following criteria:

- recruitment and selection procedures

- personnel records for each employee

- employment contracts

- induction procedures

- general conditions of employment

- employee leave entitlement

- termination procedures

- employee remuneration and other benefits

- equal employment opportunity and harassment policies

- training and continued education procedures

- performance review procedures

- internal grievance resolution procedures

Businesses need to create strategies to ensure employee retention. An effective employer/employee relationship does not necessitate becoming friends and being involved in social interactions. Rather, building relationships that foster mutual trust, respect and accountability for direct responsibilities will develop a workplace culture around job satisfaction. Where employees are happy in their role and their environment, they are more likely to remain with the business.

The Australian workforce is ageing. As older employees retire, the number of skilled and experienced workers available to fill the vacated positions will decrease. Therefore, it is essential for businesses to consider what workers expect from the employment relationship.

Some of these expectations include:

- job satisfaction

- work/life balance

- flexible working conditions

- open lines of communication

- workplace culture

- recognition

- appropriate rewards

- consistent guidelines

Greater employee retention strategies are essential for maintaining competitiveness and sustainability, which in turn leads to enhanced employee satisfaction and motivation.

The Fair Work Act 2009

The Fair Work Act 2009 was passed on 7 April 2009, as a part of the then newly-elected Labour government’s election promise to abolish the Howard government‘s Work Choices Act. This is the main legislation that governs the employee/employer relationship in Australia. It was designed to provide a safety net of minimum entitlements, enable flexible working arrangements and fairness at work, and to prevent discrimination against employees.

In summary, the new laws altered the awards system, and significantly changed unfair dismissal laws. However, there are a number of other areas covered in the Fair Work Act. These include:

- changes to unfair dismissal claims

- changes to federal award systems

- changes to the minimum wage

- record keeping

- discrimination

- new allowances

- restrictions on overtime payments

- paid tea breaks every four hours; and

- restrictions on the number of hours an employee can work

The government has established an information service for employers, regarding any queries or concerns they may. Employers are able to access Fair work online – employers for further information.

Types of employees

When recruiting employees, businesss should consider the three categories in which staff are able to be employed. This should be stipulated at the time of engagement and confirmed in the employment contract. The categories are:

Full time employees

A full time employee is engaged in work for 38 hours per week, or an average of 38 hours per week over a fortnight or four week period. The actual hours can be agreed upon between the employer and the employee set out by an award or registered agreement.

The employee can be hired as permanent or fixed term contract. Permanent employees are employed on an ongoing basis until the employer or employee ends the employment relationship. Fixed term employees are only employed for a specific period of time or task.

Part time employees

Part time employees work on average less than 38 hours per week.

The part time employee’s hours of work should be reasonably predictable. The regular pattern of work for the part time employee will typically be agreed in writing before the employment is commenced. The contract is also usually written and will include the number of hours to be worked each week and the days of the week that will be worked. It will also stipulate the starting and finishing times of each day, however, the contract may be varied by agreement and recorded in writing.

Part time employees are entitled to the same terms of the award as full time employees on a pro rata basis. This means they accumulate sick leave and annual leave entitlements, and are subject to all other National Employment Standards.

Like full time employees, they can be engage as either a permanent employee or on a fixed term.

Casual employees

Casual employees are engaged on an hourly basis, to work up to a maximum of 38 hours per week. They have no guaranteed hours of work, usually work irregular hours, are not entitled to sick or annual leave and can end their employment without notice, unless notice is required by registered agreement, award or employment contract.

The core of their employment is different to part time, full time or fixed term employees, and they will be paid at an hourly rate of 1/38th of the weekly rate appropriate to the employee‘s classification.

In addition, a 25% loading of that rate will be paid instead of the full time annual leave entitlements. Casual employees generally have a minimum period of engagement of three hours.

To find out more about the different types of employees refer to: Fair Work Ombudsman – Types of employees.

National employment standards

The Fair Work Act provides a safety net of minimum employment conditions called the National Employment Standards (NES). Under the NES all national system employers must provide 10 minimum entitlements to full-time and part-time employees:

- Hours of work – a maximum standard working week of 38 hours (plus reasonable additional hours) for full time employees

- Right to request flexible working arrangements – where an employee has at least 12 months of continuous service, they have a right to request flexible working arrangements if they are:

- A parent, or have the responsibility for the care of a child who is school age or younger

- A carer

- Have a disability

- Are 55 or older

- Are experiencing violence from a member of their family; or

- Provide care or support to a member of their immediate family or household, who requires care or support because they are experiencing family violence

Flexible working arrangements may include changes in hours of work, patterns of work or location of work. The request needs to be in writing outlining the changes requested and the reasons for the changes. The employer must respond within 21 days with a decision (to grant or refuse the request). If the employer refuses it must be done so on reasonable business grounds

- Parental leave – When an employee has at least 12 months continuous service they have a right to 12 months of unpaid parental leave after the birth or adoption of a child, and the right to request to extend that period by a further 12 months (which can only be refused on reasonable business grounds)

- Annual leave – Four weeks paid annual leave (five weeks for certain shift workers). Part-time employees get a proportion of this based on the hours they work. All employees can access 2 days unpaid compassionate leave and 2 days carer’s leave

- Long service leave – The right to accrue long service leave

- Personal/Carer’s leave and compassionate leave – Ten (10) days paid personal/carer’s leave each year for full-time, non-casual employees. Part-time employees get a proportion of this depending on how much they work. Two (2) days paid compassionate leave for each permissible occasion when a member of the employee’s immediate family or household sustains a serious illness, serious injury or dies

- Community Service leave – an employee has a right to community service leave for eligible community service activities such as jury duty or activities with dealing with an emergency or natural disaster. Community service leave is unpaid, with the exception of jury service. Payment for jury service is capped at ten (10) days. An employee must give you notice of their absence as soon as reasonably practicable and must tell you how long they expect to be absent from work

- Public holidays – The right to the day off on public holidays if the employee would have usually have worked on that day and the right to be paid for the ordinary hours of work on that day. Employees can be asked to work on these days if the request is reasonable, and employees can refuse to work on these days provided that the grounds for refusal is reasonable

- Notice and redundancy payments – a minimum amount of notice in writing prior to the termination of the employment, where the notice period will be determined by how long the employee has worked for the employer.

There is entitlement to redundancy payments in certain circumstances, if the employer no longer needs the employee’s job done by anyone, or because of insolvency, bankruptcy of the employer. The redundancy payment is calculated by using the employee’s base rate of pay and their length of service with the employer - Fair Work Information Statement – Employers are required to provide a copy of the ‘Fair Work Information Statement’ to all new employees before or as soon as practicable after the commencement of employment. The Fair Work Information Statement is published by the Fair Work Ombudsman and available to download here:Fair Work Information Statement.

The parental leave and notice of termination entitlements also apply to casual workers.

The Fair Work Ombudsman has also produced a useful reference guide that summaries businesses responsibilities under the Fair Work Act 2009, the National Employment Standards, and other employment agreements. The latest version is dated May 2015 and is available here.

Paid Parental Leave Scheme

The Australian government introduced its first national paid parental leave  scheme on 1st January 2011. Under the scheme, eligible working parents are entitled to 18 weeks leave, paid at the national minimum wage rate, when having a child or adopting a child.

scheme on 1st January 2011. Under the scheme, eligible working parents are entitled to 18 weeks leave, paid at the national minimum wage rate, when having a child or adopting a child.

In order to be eligible for the scheme, the worker applying must be the primary carer of a newborn or recently adopted child. This can be either the mother or the father, but not both at the same time; however the 18 weeks can be split between both parents. The worker applying must be an Australian resident and be receiving an adjusted taxable income of $150,000 or less in the financial year prior to the date of birth. Adjusted taxable income includes the following:

- taxable income

- tax-free pensions or benefits

- target foreign income

- reportable super contributions; and

- adjusted fringe benefits, i.e. reportable fringe benefits multiplied by 0.535

- total net investment losses; less

- deductible child maintenance expenditure

The worker must have been employed by the employer for a minimum of twelve months prior to the expected date of birth, and will continue to be classed as an employee whilst on paid parental leave. The worker must be on leave or not working from the time they become the primary carer.

Dad and Partner pay is available for eligible working dads or partners, including adopting parents and same sex couples. They are eligible to get up to 2 weeks of pay based on the rate of the national minimum wage.

Parents who wish to claim paid parental leave will need to register through the Family Assistance Office, providing evidence to demonstrate their eligibility. Parents then notify the employer and agree on leave arrangements. The employer registers with the Family Assistance office to ensure that all payments are received prior to the date payments to the employee are due. Paid parental leave can be taken in conjunction with, or in addition to employer provide leave such as annual leave.

The employer’s responsibility

The employer will need to register for the paid parental leave scheme:

- employers are responsible for providing paid parental leave to eligible employees who are expecting to receive more than 8 weeks paid parental leave

- any employees who opt for less than 8 weeks parental leave will be paid directly by The Family Assistance Office, not the employer

- to be eligible parents must be employed under the Fair Work Act

- the Family Assistance Office will advance the employer paid parental leave funding, there is no obligation to provide paid parental leave until the funds are received from the Family Assistance Office – therefore employers should encourage their eligible employees to register with the Family Assistance office early to ensure the funds are received before they are due to be paid to the employee. This will not cause cash flow issues within the business – payments are transferred to the employer prior to the pay cycle

- the employer is able to preregister with Family Assistance Office in order to simplify the process

- parental leave funds are classed as taxable income, and should be separately identified for annual financial statements; Generally the funds declared will be received in the same financial year as the claim for the deduction for payment for paid parental leave

- reasonable costs of complying with paid parental leave scheme are tax deductable; these include software expenses or necessary expenses incurred in carrying on a business

- leave entitlements do not accrue while the employee is on paid parental leave, and is not classed as ordinary time earnings therefore does not attract super guarantee contributions. Paid parental leave is not subject to payroll tax, and will not attract additional workers compensation liabilities

For further information on this scheme, refer to: Paid Parental Leave Scheme.

Employment contracts

It is important to determine the correct award classification for each staff member.

Job descriptions are important for clarification of these areas. Under the awards, employers are able to pay above award rates, however, the contract must state what the higher rates are covering, and that the employee is better off overall than they would be if they were receiving all additional award entitlements. The employment agreement must be signed by both parties; otherwise the additional entitlements will still apply.

It is a good idea to provide individually signed and written business cases to staff, outlining how their over award payments and conditions make them better off overall. Staff must not be forced to sign these agreements, as signing under duress gives the employment no legal protection from an underpayment claim. It is critical to ensure that all employment agreements address the award obligations line by line.

A general statement such as “this over award payment will cover all your penalty, allowance and overtime benefits” is not satisfactory. Details need to be spelt out in the employment agreement.

The employment contract should include the following details, as a minimum:

- date, name and address of employe

- offer of employment, statement asserting replacement contract

- employment duties

- hours of work

- remuneration and benefits:

- wages

- allowances

- super

- business expenses

- health and safety

- leave entitlements:

- public holidays

- annual leave

- personal carers leave

- compassionate leave

- long service leave

- community service leave

- general conditions:

- conflict of interest

- confidentiality

- intellectual property

- commissions

- internet/email/computer/mobile phone

- viruses

- unacceptable use

- security

- dress

- policies

- indemnity

- jurisdiction

- post employment obligations

- code of conduct:

- principles

- attendance

- performance of duties

- drugs and alcohol

- property

- vehicles

- safety procedures

- false declarations

- personal behaviour

- harassment

- gambling

- confidential information

- media statements

- smoke free environment

- outward goods

- termination

- notice

- redundancy

- effective date

- agreement signatures

Discipline and termination of staff

Disciplinary action cannot be taken against an employee without justifiable reasons. Every employer should have effective policies and procedures in place to guide the process, with any required action using commercial common sense with the utmost respect for the rights and feelings of the employee. The following chart identifies and explains some common disciplinary issues:

| Issues | Further explanations |

| Attendance problems |

|

| Dishonesty |

|

| Performance issues |

|

| Behavioural problems |

|

The four basic steps for disciplinary action are: documentation, investigation, progressive discipline and termination:

Documentation

Document all actions and follow a procedure designed to prove to a court that the correct procedures were followed. A good rule is to simply assume everything that has occurred will be eventually put under scrutiny by a court. All interactions should be documented in writing, including file notes of discussions and specific examples of inappropriate behaviour. It is appropriate to have witnesses wherever possible. Witnesses need to sign and date the file notes. Failure to accurately record disciplinary actions may result in the reversal of any action taken. (for example, a dismissed worker may be reinstated).

Investigations

In many cases, the investigation of an incident will be enough to prompt a change in the behaviour of the employee. In the case of an employee who is not performing well, but who is positive about improving their performance and is not engaging in serious misconduct, the following course of action should be followed:

- talk with the employee about their performance. Let the employee know exactly what is required of them and how they are falling short of this standard. Try to do this in a friendly and non-threatening way. An approach that is too strong may trigger a defensiveness, which may frustrate the whole process

- the employee should be given an opportunity to respond to the concerns and to explain their point of view, how they perceive their work performance has been, and whether they think it can be improved, or whether there are any extenuating circumstances that need to be considered; and

- often this will be the end of the matter. Both the employer and the employee will have benefited from a full and frank discussion regarding the matter, and the situation will improve immediately (or at least improve over the following few weeks)

Progressive discipline

Progressive disciplinary procedures should be applied to minor indiscretions. A further meeting should be held, preferably a few days after the initial meeting, when the employee has had the opportunity to reflect on the issues unemotionally and perhaps talk with friends and family. At this next meeting, performance targets and goals should be set, including time limits. Documentation of these targets and goals is essential, and the agreement of the employee should be obtained and recorded in writing. It is often a good idea for more than one person to be present at each of these meetings. In particular, if the employee is a young female and the employer is a male, it may be appropriate for the third person to be an older independent female.

If this discussion does not end the matter, and after an appropriate period there is no improvement, then the above procedure should be repeated. Again, the concerns of the business and the proposed course of action should be put in writing, and witnessed by an independent person.

Correction or dismisssal

If the position still does not improve, then a third and final warning should be given. This warning should be very direct and to the point, and should refer to all previous discussions and correspondences. It should state unequivocally what the required standards of performance are, and that the consequence of the employee not reaching this standard by the specified date, will result in dismissal. If the third warning does not have the desired effect it is appropriate to consult a legal professional or Fairwork.

It is important to bear in mind the position of the employee, and the possibility that they are preparing to move on by the time they receive the third warning. Favourable references and some common sense on the part of everyone concerned may assist the employee to consider other options.

Notice periods

The Fair Work Act 2010 altered the termination notice periods given to unsatisfactory employees. Upon termination of employment, an employer may have to comply with the federal notice periods that provide for mandatory minimum notice periods prior to ceasing employment. This gives an employee the chance to receive wages for this period, and secure new employment with a smaller gap between jobs.

There are some exceptions to the notice periods. Most significantly, these notice periods do not apply to employees guilty of serious misconduct (discussed in further detail below). Other circumstances where the notice periods do not apply include:

- dismissal of casual employees

- employees who earn above the threshold amount (currently $108,300)

- temporary employees who operate under contract; and

- employees under a probation period, which is generally up to three months

The table below sets out the notice periods compared to the period of service:

| Period of service | Notice period required |

| Up to one year | One week |

| More than one year but less than or equal to three years | 2 weeks |

| More than three years but less than or equal to five years | 3 weeks |

| More than five years | 4 weeks |

Further details on the notices periods, can be accessed at: Fairwork notice and redundancy calculator.

Serious misconduct

Employers do not have to accommodate serious misconduct. Serious misconduct is defined in the Industrial Relations Act as:

…misconduct of a kind such that it would be unreasonable for the employer to continue the employment during the notice period and which must be taken as a repudiation of the employment contract by the employee.

Examples of serious misconduct are:

- dishonesty against the employer

- conflict of interest (e.g. working for a competitor, or competing with the employer after hours: at least in some industries):

- referring work away from the employer; and

- committing a serious breach of the law (e.g. stealing)

When faced with serious misconduct on the part of an employee, such as a significant theft or other dishonesty, an employer should:

- investigate the matter fully, reasonably and impartially, and fully document the steps taken in this investigation. It can be a good idea to ask an independent third party, such as an accountant or a solicitor, to help with this investigation

- specify exactly what the employee is alleged to have done. Document all the details, including times, dates, places, the names of any witnesses, or the details of any corroborating evidence

- speak to the employee, put the allegations to them and allow them to respond. Consider any mitigating factors (for example, thirty years of happy service may mitigate a minor theft of stationery); and

- consider the other available options. Apart from dismissal, these could include a suspension, a demotion or a transfer. Generally though, if the misconduct is serious, the wisest solution is usually to dismiss the employee. This is particularly the case given that the misconduct of which the employer is aware may not be the only misconduct that has occurred

Each of the above steps should be documented, and, preferably, should involve an independent person as a witness. Again, the witness should sign and date these documents. Any breach of criminal law should be reported promptly to the police. Let the law make up its mind as to what action should be taken.

Unfair dismissal

Under the Fair Work Act, employers cannot dismiss their employees in circumstances that are harsh, unjust or unreasonable. Whether the dismissal is harsh, unjust or unreasonable will depend on the circumstances of each case.

Under section 385 of the Fair Work Act a person will be unfairly dismissed if the Commission is satisfied that the employee’s dismissal was:

- Harsh, unjust or unreasonable; and

- Not consistent with the Small Business Fair Dismissal Code (for small businesses with less than 15 employees); and

- Was not a case of genuine redundancy

An employee who has been dismissed can make an application for unfair dismissal if they:

- Have completed 6 months of employment; and

- They earn less than the high income threshold (currently $136,700 pa); or

- A modern award covers their employment; or

- An enterprise agreement applies to their employment

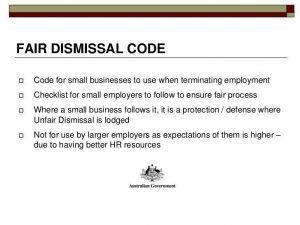

For small businesses that employ fewer than 15 employees there are special arrangements which are different to larger businesses. The special arrangements which apply to these small businesses mean that:

- employees will need to have worked for the business for at least 12 months in order to be eligible to make a claim for unfair dismissal; and

- if a small business employer strictly follows the Small Business Fair Dismissal Code and the dismissal of the employee is not harsh, unjust or unreasonable, then the dismissal will be deemed to be fair

The Small Business Fair Dismissal Code

In summary, this code provides for the following dismissals:

Summary dismissal

Where the employer can dismiss the employee without notice or warning then  the employer believes on reasonable grounds that the employee’s conduct is sufficiently serious to justify immediate dismissal.

the employer believes on reasonable grounds that the employee’s conduct is sufficiently serious to justify immediate dismissal.

Other dismissal

In all other cases, the employer must give the employee a valid reason why he or she is at risk of being dismissed based on the employee’s conduct and/or capacity to do their job. The employee must then be provided an opportunity to respond and a reasonable chance to rectify the problem.

The code provides a detailed checklist to help small business employers comply with the code. This will help the employer assess and record their reasons for dismissing an employee. However, completion of the checklist does not in itself prove that the code has been complied with and only acts as a guide.

A copy of the code and checklist is available here: Unfair dismissal – Small Business Fair Dismissal Code.

For more information regarding the process and timelines and the protections afforded to employees protected under this scheme, refer to the latest versions of the Fair Work Unfair dismissal Benchbook published 18 September 2015 here: Benchbook – Unfair Dismissal.

Anti-discrimination legislation

Australia has a variety of anti-discrimination laws, on both state and federal levels. The human rights and equal opportunity commissions oversee and administer the federal legislations, to ensure that no employees are unfairly discriminated against.

On a federal level the legislation includes:

- Racial Discrimination Act 1975

- Sex Discrimination Act 1984

- Disability Discrimination Act 1992; and

- Human Rights and Equal Opportunity Commission Act 1986

Defining discrimination

Discrimination involves treating a person unfavourably because of an attribute or a characteristic that distinguishes them from others. The characteristics include race, culture, origin, skin colour, gender, family status, family responsibilities, union membership, disability, health, physical features, political association, sexual orientation, and religion.

Discrimination does not have to be direct. It can be indirect. For example, promoting employee A because he voted for a particular political party in the last election, could mean that employee B is indirectly being discriminated against due to the political association. The promotion was not offered based on his or her merits, and employee B was not given the same opportunity as employee A.

A further example could be a company policy that reads: “All staff members, without exceptions, are to wear work uniforms at all times, without any additional accessories whatsoever.” This could be discriminating as some cultures and religious beliefs require that followers wear a head cover, very modest clothing, or piercings. Therefore, a company policy should be flexible enough to accommodate these needs. More appropriate policy could therefore read: “Staff members are required to wear work uniforms at all times, without any additional accessories, unless:

- other agreements are entered into in writing with management; or

- the uniform requirements contravene your personal cultural or religious beliefs.”

Intention is irrelevant in anti-discrimination laws. Therefore, it is not sufficient to claim lack of intention to discriminate.If you discriminate, that is illegal.

Grievances

All employers should have procedures for dealing with conflict, and it is essential that employees must be given access to grievance procedures. All complaints or grievances from staff must be recorded, and a copy filed in the employee‘s personal file. Understanding conflict will assist with dealing with grievances.

Differing opinions or ideas amongst team members can produce conflict; this may be caused through differing cultural beliefs and backgrounds, or from varying skills and experience.

However, conflict is not always negative and can usually be resolved when dealt with appropriately. Unresolved conflict can result in frustration amongst the team members, which may develop into negative competitive behaviour, increased stress and lower morale. It can also cause resentment and ongoing anger, decreased efficiency and increase in staff turnover. Conversely, when handled correctly, differing opinions can be productive and encourage creative solutions, generate innovation and increase communication.

In order to manage conflict effectively, it is important to understand the five different strategies commonly used for resolving the issues that may arise:

| Strategy | Description |

| Competing | Combining assertive and uncooperative behaviours in an effort to win at all costs. A lot of energy is exerted to prove a point, and power is often used to pull rank with little regard for the other party involved. |

| Accommodating | Combining unassertive and uncooperative behaviours in order to resolve the conflict. Where the needs and wants of the person trying to resolve the conflict are often not given consideration to the resolution process. The opposite to competiton. |

| Avoidance | Combining unassertive and uncooperative behaviours in order to escape confrontation. Avoiding interactions that may involve conflict. |

| Collaborating | Combining assertive and cooperative behaviours that all parties are comfortable with in order to implement a solution following investigation of the causes and issues. The opposite of avoidance. |

| Compromising | Intermediate between assertiveness and cooperativeness. Solutions are based on finding the middle ground and making allowances and concessions by both parties. |

Chapter 3: Time Management

This section introduces the concept of time management and identifies areas where busy business owners can better balance the demands placed upon them.

This section introduces the concept of time management and identifies areas where busy business owners can better balance the demands placed upon them.

There are two classic books relating to the area of time management. They are The Effective Executive by Peter Drucker (Butterworth & Heineman 1967), and The Time Trap (Alec Mackenzie, American Management Association 1990). Both books are recommended reading. They underpin all later writings on time management.

The Time Trap

In part 2 of The Time Trap, Mackenzie identifies the twenty biggest time  wasters, along with suggestions on how to respond to them. The following extracts follow this format, with some additional comments and concerns added.

wasters, along with suggestions on how to respond to them. The following extracts follow this format, with some additional comments and concerns added.

Meetings

Surveys indicate that up to half the time spent in meetings can be wasted. In reality it is probably more: as some of the respondents to these surveys simply may not want to admit they waste more than half their time. Some meetings go too long. Some meetings should never be held.

Before calling or attending a meeting, the following questions should be considered:

- does there need to be a meeting? Perhaps others can simply set out proposed solutions, and ask others involved if they are agreeable

- can the meeting be deferred? Why are so many meetings held on a monthly basis? Can schedules be altered to every second, or even third month, rather than a monthly meeting

- do all participants need to attend?

- if not, who does need to attend? People should not be invited out of courtesy. Unnecessary attendees will participate, regardless of whether it is appropriate

- can the agenda with time allocations be prepared and circulated ahead of time? If so, then participants should strictly follow the agenda and the time allocations

Staff meetings and meetings with co-owners should be distinguished from a social catch up. Always bear in mind the opportunity cost sacrificed to attend the meeting, and ensure that all information is ascertained in the most time effective manner.

Travel

Travel can be a big time waster. For the owner running their own business, it makes sense to live near the business. Driving an additional 30 minutes each way, each day, adds up to four extra weeks over a year.

You should avoid other forms of travel when possible. The use of couriers, phones, e-mail or faxes, teleconferencing, and online video conferencing can help minimise travel. If travel is required for a conference or a meeting, check any alternative or quicker options. If you are required to attend a meeting which requires extensive travelling, consider using a teleconference or Skype instead.

An example:

Skype is free of charge, as long as both parties to the conference are online at the same time. Computers and monitors typically have an inbuilt video camera which makes this option even easier. Once Skype is installed, and owners are comfortable using it, a video conference meeting can be held, even with people who are only 20 minutes away, avoiding the need to travel in traffic or search for parking.

The telephone

The telephone can be a big time saver, or a big time waster. Properly handled it is a powerful tool that generates significant savings and efficiencies, and is an integral telecommunication tool in the day-to-day operation of the business. The most important telephone rule is to have an effective screening mechanism. Calls must be filtered, so only urgent calls are taken straight away and other important calls are deferred until it suits. A junior staff member should handle less important calls. Staff should be encouraged to tell an unwanted caller (for example a salesperson), in a professional manner, that their call is unsolicited, and not to call back. This is the best way of making sure no more time is wasted.

The other potential problem is spending too much time on a call. Politeness is essential, but digression from the purpose of the call should be skilfully managed. Use verbal cues to direct incoming calls to business issues, and exclude non-business issues: commencing with “what can I do for you” is brilliant. It smacks of service, is an offer of help and focuses on the issues at hand. Practised lines for ending the call are also needed. To close politely, say something like “well, we will see you next Tuesday at 9.00am.” These, or similar words, let the other person know the call is closing. And then you can close it. If other party is not finished and something else needs to be discussed, this is a very quick way of prompting it.

Effective communication

Clear communication can save a significant amount of time. This involves listening, reading carefully, and speaking and writing meticulously, to clearly understand what information is being conveyed. A staff member coming back for a further explanation of a task costs time for everyone involved. There is also the time spent by the staff member inefficiently trying to understand what has been said before deciding they need to revisit the issue with you.

When instructing someone, test for receptivity. It is important to ask questions and invite feedback to gauge understanding.

Clearly and succinctly explaining instructions initially saves time in the long term.

Delegation of management tasks

Delegation is an art. It is also an essential feature of all good businesses. The most effective concept is to employ qualified staff, train and induct them thoroughly, and to empower them to undertake their roles. Comprehensive position descriptions and otherwise clearly outlining responsibilities are very important. Communication is also important to ensure all team members are aware of the ‘big picture’, or mission of the organisation, and the part they play in it.

Time is a scarce commodity. It makes sense to ration it. Delegating all appropriate tasks to responsible people, allowing the owner or principal to concentrate concentrating on client service delivery, is the key to running a successful business – and getting home before dinner each night.

Some practical guidelines for effective delegation include:

- small mistakes should be expected; they are rarely fatal, and staff will learn from them. When a mistake occurs, look at the system not the incident. If an adequate system is in place the incidents will stop

- perfection should not be expected. In some cases “adequate is enough.” Adequate costs less and takes a lot less time

- results should be examined, rather than the process. It is the end result that matters: if the desired result is achieved by someone else using a different method, (within reason) it does not matter; and

- staff should be loyal and reliable. If they are not, consider whether they are helping or hindering your business. (See below)

Paper work

The problem with paperwork is that it takes time to create, read, and store. Introducing efficient paper handling procedures saves time. Some good ground rules are:

- paper should be handled only once. Decisions should be made quickly: more than 80% of matters can be handled at the first contact

- the waste paper bin should be used. If it is not required to be kept, then bin it, don‘t store it

- scanners are great. If you do need to store it, can you store a digital copy and shred the original? and

- paper work can be reduced and simplified by developing systems, including standardised forms and common filing systems

The right staff

Selecting appropriate staff, and then developing their skills further, both in an on-the-job setting and, if suitable, a more formal external setting, is essential. External training should emphasise people skills and routine management skills, including personal organisation, and time management skills.

When recruiting staff, time should be spent getting to know the candidates. Although instincts should be trusted, time should always be taken to personally check references. Regardless of how impressive a new recruit may appear, it wise always to implement 3 months probation as standard. Doing this allows many decisions that may have seemed like a good idea at the time to be reversed.

Do not set too high a benchmark for yourself here. You will, at least sometimes, employ the wrong person for your business. Identify that early and be prepared to act. If they do not suit you, you probably do not suit them.

Investing time and effort in your staff has the benefit of a better-trained and more knowledgeable team, with a correlating high productivity. It also sends the message that the business values its staff. This in itself can help produce excellent results through the actions of a much-better motivated team.

Self-discipline

Vigilance and a regular return to basics helps maintain high standards of self-discipline that convert to better time management and personal productivity.

Self-discipline can be improved fundamentally by setting goals. These should be for the long term, the short term and the immediate. The degree of precision and detail is greater with a shorter time period. Committing goals to paper and constantly refreshing your memory and consciousness of them creates focus and facilitates achievement. This process should be systemised. The system should range from the informal – a few minutes planning each morning and a brief review each evening – to a more formal process for setting and pursuing longer term goals.

It is difficult to achieve goals if the goals have not been identified. The title of Wayne Dyer‘s book “You Will see it When you Believe it” speaks volumes: the mere act of putting pen to paper can facilitate achievement by drawing attention to the tasks that most require it.

This task could be as simple as writing a to-do list or as complex as a large scale business plan. Goals should reflect priorities, and should distinguish between important tasks and urgent tasks. The important things should be time defined. If something must be omitted, ensure it is not important.

You should also use goals, budgets, and checklists, to ensure you are performing to the best of your abilities. For many of these goals, this should be done publicly: keep in mind that support staff will observe your behaviours. They will identify expected work ethics and the organisational culture from your example.

Prioritising

High calibre executives manage to perform their roles effectively by prioritising their time well. Confidence is required to decide: which tasks can be performed at a later stage; which tasks require more time and attention; and which tasks can be performed by someone else. Successful leaders are not the ones who manage to do everything, but the ones who manage to get everything done.

Many people fall into the trap of performing many tasks at the same time. This is likely to compromise the quality of the performance – and increase stress levels. Prioritise so that you do the most important things first. Then do things, and do them well, one at a time.

Urgent tasks

Urgent tasks are the wild card. By ‘urgent’ we mean in the sense of time, not importance. There is a big difference. Techniques need to be developed to handle the urgent, unimportant tasks routinely: for example, setting aside an hour a day for returning low level calls and correspondence (or, even better, assigning someone else handle these).

It is a good idea to set aside time on the weekly planner for the (expected) unexpected urgent tasks. A blank hour scheduled can make all the difference. For example, you may decide not to schedule any meetings or routine work between, say, 1.00pm and 3.00pm each day. This leaves this time free for routine important matters.

Monitor progress

Self assessment is a useful tool. Tasks need to be completed in a timely and competent fashion. The same applies with goals: progress needs to be monitored, and self-correction enlisted if there has been a deviation from the course.

Healthy competition is a powerful motivator. Setting budgets and standards that need to be achieved can increase productivity and enhance self-motivation. Achieving measurable, achievable goals can be highly satisfying and increase motivation.

Utilise technology

These days, businesses have the benefit of superior technology that was unavailable twenty years ago. This can vastly improve efficiencies in many areas. Personal computers, automated business systems (including client recording systems ), and everyday IT such as the internet and internal and external e-mail systems, support productivity and profitability. The cost of these technologies is typically minimal compared to the benefits.

Recent developments in technology include phones with internet access and video conferencing.

Socialising

This is often an area where big time savings are possible. At work, social time should be pruned to the minimum. Learning how to politely discontinue non-essential discussions and re-focusing thoughts on the matters at hand will minimise wasted time in a busy schedule. The “minimum” is, of course, a personal thing. Taking this concept too far can lead to loneliness and isolation and be interpreted as aloofness.

Socialisation is a work-place lubricant that maintains good relationships with peers, staff and clients. In finding the right balance it is relevant to bear in mind that studies have shown more than a third of an executive‘s time can be spent on non-business interactions. Where time means money, or where time is scarce, this sort of pattern can be problematic and lead to sub-optimal performance.

Avoid employing overly social people, (aka ‘timewasters’): actually ask about this when checking references. Whilst it is critical for staff to have good communication skills, and it is commendable for them to have the ability to socialise well with other staff, a balance is necessary in order for the business to run efficiently.

More Tips

You can read more tips for managing time by the good people of New York University and Psychology Today by following these links.