You may have seen reports this week of ASIC’s inquiry into the way life insurance companies pay insurance claims.

The inquiry was inspired by media reports earlier this year of people being denied claims based on outdated definitions of events such as heart attacks. You can read one of these reports here. This report is one in an excellent series of investigative journalism provided by Adele Ferguson and Fairfax.

ASIC’s inquiry revealed some really interesting facts about the treatment of life insurance claims. Basically, their inquiry revealed that insurance companies are not very generous when it comes to paying claims. Perhaps we should not be surprised about this: if the insurer pays a claim, their profits fall. But there were also some interesting ‘sub-plots’ in the report. We will discuss some of them in a second.

Given the ASIC findings, we can expect the insurers to lift their game in terms of paying legitimate claims. But they will only ever have to pay a legitimate claim, and whether a claim is legitimate or not usually depends on the policy that was taken out in the first place. It is really critical that you get this part of the puzzle right.

Claims that are paid

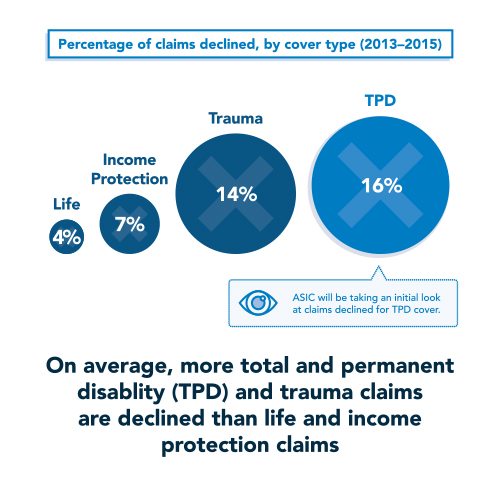

ASIC provides this infographic about the percentage of claims that are declined.

90% of claims are paid in the first instance.

This might seem like a reasonably high level, but remember that life insurance claims are not like other insurance claims. Death cover, for example, only pays when a person dies. So people simply don’t make claims unless the insured event has actually occurred. 10% rejection is therefore quite high.

TPD is the most rejected type of claim

The most rejected type of claim was for TPD. TPD stands for total and permanent disability. 16% of all claims for TPD were rejected. But there was huge variation here. Some insurers rejected more than a third of TPD claims.

The problem with these kind of claims is often in the definitions. Some insurers use a very strict definition of what constitutes the ‘insured event.’ The insured event is the thing that you are insured for – in this case, becoming totally and permanently disabled. 16% of people who thought they were covered for TPD actually weren’t – or at least, there was enough doubt that the insurer felt it could argue that they were not covered.

Trauma claims are not far behind

14% of all claims for trauma cover were also declined – for pretty much the same reason as TPD. The insurer argued that the trauma had not occurred in the way required by the policy. Of course, they would know: they wrote the policy.

The highest rejection rate by an individual insurer here was 25%.

Claims were most likely to be rejected when the client bought the insurance directly

People seeking life insurance do not have to use an adviser. They can contact the insurer directly and arrange their own cover. The inquiry revealed, however, that claims were much more likely to be accepted when the client saw a financial adviser before taking up the policy. Using advisers led to more successful claims. This makes sense, really. Financial advisers are expert at things like policy definitions and assessing a client’s particular need for cover. When clients go DIY, they often pick the wrong policy or agree to something within a policy that they should not agree to.

For example, many clients do not know that the definition of ‘disability’ in TPD varies. Some insurance policies use an ‘own occupation’ definition. Others use an ‘any occupation’ definition. If the policy uses an any occupation definition, then you have to be more disabled in order for a claim to be accepted. While it is not quite this simple, you basically need to be so disabled that you cannot work in any occupation. Investopedia puts it this way:

The “any occupation” definition is the stricter definition of disability, where you are unable to work in a job that is reasonably suitable for you based on such things as education, experience and age.

You can see there is a nuance here: you only need to be disabled such that you cannot do suitable work, rather than any work. Physiotherapists who become unable to do that work are not expected to work at McDonalds. But they might be expected to become University tutors, or personal assistants, or something like that.

The own occupation category is a better one for claimants: in this category they need only to be disabled such that you cannot pursue that particular occupation. The point is that simply having TPD cover is not enough: you need to have the right TPD cover.

Whether you can and whether you should prefer an ‘own occupation’ or an ‘any occupation’ kind of claim depends on your circumstances. And the evidence shows that people are not very good at understanding their own circumstances: remember, one insurer is finding a way to reject more than a third of TPD claims. Remember also that the insured person thought they were covered: that is why they made a claim in the first place. When they finally discovered they were not properly insured, it was too late.

Insurance policies can be complex. But insurances are necessary for many many people. People who go directly to the insurer are more likely to choose the wrong policy and then have a subsequent claim rejected. So, if you are looking at life insurances, make sure you at least talk to an adviser before taking out life insurances.