Welcome to our share market update for October 2016. We like to do our updates differently here. We use the updates to teach you a little about the mindset that is required if you are going to succeed in investing into the volatile market that is the share market.

We would love to know what you think of this approach.

Australian Share Market

The Australian share market ended the month of September 2016 basically unmoved from its level at the end of August 2016. As measured by the ASX 200, the market fell just two points, to 5,433.

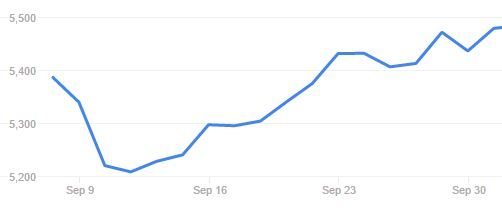

But sometimes looking at the value of a share market at two single points in time can be misleading. During the month of September, the market actually rose as high as 5,471 and fell as low as 5,207. Depending on which end you start at, this represents variance of up to 5% over the period. You can see this on the following graph (thanks to Google Finance) which is anything but a flat line:

This is, of course, a really common occurrence in volatile markets like the share market. It gives rise to a form of risk known as timing risk. As that name suggests, timing risk is the risk that you will buy or sell on just the wrong day.

In the month of September, the worst day to buy was Thursday September 29, when the market peaked at 5,471. On the flip side, that was the best day to sell. On the flip side, the best day to buy was September 13, when the market was at its lowest point for the month.

The problem, of course, is that no one knew on September 13 that the market’s next move was up. If they did, they wouldn’t be telling anyone anyway. They would have been too bust buying themselves.

For the twelve month period ending on September 30 2016, the market moved from 5,052 points to 5,433. This is a rate of capital growth of 7.5%.

But once again, during the year things were far more volatile. In February, the market fell as low as 4,765. This was 5.6% below the level at the end of September 2015. On the first of August 2016, the market reached 5,587. Again, depending on which end you start at, this suggests volatility within the year of 17.25%.

Fortunes rise and fall on timing issues. The great news is that they can be managed, in much the same way as the specific risk of an individual share holding can be managed by diversifying across multiple companies. The buying and selling of shares can be diversified over time. Talk to us and we can show you how.

Dividend Yield

Shares create value for their owners in two ways: dividends and capital return. Dividends are the payments you receive when you still own the share. Capital return is the difference between your buy price and your sell price. To realise a capital gain, you need to sell the share. (Shares that have gone up in value since you bought them, but that you have not yet sold, provide unrealised capital gains).

When you look at share price indices over a fixed period of time, you are really only seeing the capital rate of return for that period. Dividends are not really part of the comparison picture. (For the technically-minded reader, you may know that share prices reflect declared but unpaid dividends, and so the market price often does include the dividends that are to be paid, or are expected to be paid. However, because these dividends are in place at both points in time, they tend to cancel each other out when we look at changes in share prices).

The average annual dividend yield for September 2016 was 4.4%. Given 7.5% as the capital return for the previous 12 months, this gives us a total 12 month return of 11.9%.

To put this in perspective, if you obtained this rate of return for 6 years, you would double your money.

To put it in further perspective, interest rates fell as low as 4% for home loans and margin lending rates have fallen as low as 5.2%. People who borrowed to invest in the 12 months to September 2016 did well.

Long Term-ism

As we always say, investments in the share market simply must take a long term view. The above analysis underlines that advice: over the one month period, the market barely moved. For the 12 month period, it rose by more than 7%.

So, please remember: don’t put anything into the share market that you need to get out any time soon. Ten years and more is the best expected investment timeframe.